Data Centers and Behind-the-Meter Generation in PJM

- Dan Lee

- 4 days ago

- 8 min read

In April 2025, we first discussed market trends related to the AI race and co-locating new large loads and behind-the-meter generation to solve timing issues involved with interconnection. Co-locating large data centers with dedicated power plants has been pitched as a way to beat PJM’s interconnection queue and secure firm, power for AI and cloud workloads. In practice, the story has been far more complicated. FERC’s December 2025 order on co‑located load is the first serious attempt to put a clear framework around these arrangements, and it fundamentally changes how large loads can take transmission service in PJM.

This insight explores three topics:

The core issues with co‑locating large loads and generators, and what FERC did in December 2025

The four new transmission options that now exist for large loads in PJM

What still isn’t decided yet, and what to watch for in PJM’s upcoming rulemaking and filings

1. The co‑location problem and FERC’s December 2025 response

Why co‑location became such a big deal

PJM’s interconnection queue is severely congested. The timeline from interconnection request to commercial operation has stretched from under two years in 2008 to more than eight years by 2025 as PJM worked through over 170 GW of new generation requests. At the same time, hyperscale and AI data center loads are arriving in multi‑hundred‑MW chunks, often on timelines measured in 2–4 years, not 8–10.

That mismatch created the co‑location narrative: put a 900 MW generator next to a 1,000 MW data center, connect both physically on a private system, and only use the PJM grid for the last 100 MW. In theory, that should mean:

Smaller requested transmission service

Fewer network upgrades

Faster interconnection studies

In practice, three problems showed up quickly:

Stranded asset risk: Generators want the ability to sell to the grid if the data center closes, and data centers want grid backup if the generator trips. Both sides usually still want full interconnection.

Tariff gaps: PJM’s rules were never designed for very large “co‑located” loads taking some power from on‑site generation and some from the grid. The tariff assumed either traditional front‑of‑meter service, or small behind‑the‑meter generation netting with retail load.

Cost allocation and reliability concerns: Other PJM customers and the market monitor raised concerns that large behind‑the‑meter deals could avoid paying for transmission they still rely on, while also creating large, poorly understood swings in net load.

These issues surfaced in the Talen–Amazon Susquehanna case. The parties tried to expand a behind‑the‑meter nuclear supply arrangement tied to AWS data centers in Pennsylvania. FERC ultimately rejected the proposed non‑conforming PJM interconnection service agreement twice in 2024–2025, concluding PJM hadn’t shown why the deviations from its pro forma tariff were necessary and flagging broader reliability and cost concerns.

FERC’s December 2025 order: forcing PJM to create rules

On December 18, 2025, FERC issued a landmark order directing PJM—“the nation’s largest grid operator”—to create clear, transparent rules for co‑located generation and large loads. The order does three big things that matter for data centers.

Creates new transmission service options for co‑located loads. There are four options: traditional “front‑of‑meter” Network Integration Transmission Service (NITS), plus three new flavors (Firm Contract Demand, Non‑Firm Contract Demand, and Interim NITS).

Clarifies how generators can interconnect when serving co‑located load. PJM must allow interconnection at levels below nameplate, faster paths when no network upgrades are needed, and use of surplus interconnection service, rather than forcing every project through a full‑blown, worst‑case study.

Orders PJM to overhaul its behind‑the‑meter generation (BTMG) rules. PJM has to set an explicit MW threshold for netting BTMG against load, provide a transition period for existing customers, and stop treating large co‑located generation the same way as small rooftop generation netting a retail bill.

The key takeaway: FERC didn’t bless BTM as a queue bypass. It told PJM to build a set of tools that let large loads and generators share infrastructure in a way that’s transparent, priced correctly, and consistent with reliability standards.

2. The Four New Transmission Options for Large Loads

FERC’s fact sheet and PJM co‑location presentation frame the new choices around a common example: a 1,000 MW large load (think data center campus) with a 900 MW generator at the same node.

Option 1: “Front‑of‑Meter” Network Integration Transmission Service (status quo)

This is the traditional model most data centers and generators use today.

The large load takes full NITS from PJM for its entire 1,000 MW.

The generator separately interconnects and is planned as a supply resource to the whole PJM system, not just the co‑located load.

PJM plans all transmission and generation needed to serve that 1,000 MW load under its usual reliability criteria.

Implications:

Longest timelines and potentially the largest transmission upgrade bill, because PJM is planning for full firm service to the large load even if there’s substantial on‑site generation.

But this provides the broadest benefits and the cleanest integration into PJM’s capacity and energy markets, and it’s the structure most lenders and counterparties understand.

Option 2: New Firm Contract Demand Transmission Service

This is the first new option. Here, the large load only buys firm transmission up to the amount it actually expects to need from PJM.

Using the 1,000 MW load / 900 MW generator example:

The large load contracts for 100 MW of firm transmission service.

PJM has no obligation to serve the load above 100 MW under firm conditions.

All or part of the 900 MW generator is dedicated to the co‑located load via private wires or contractual arrangements.

In other words, PJM plans its transmission and capacity resources as if this were just a 100 MW firm load, not a 1,000 MW one.

Implications:

Big potential savings on transmission upgrades and capacity charges, since you’re not asking the grid to backstop the entire load.

To make this bankable, you need very high confidence in the generator and any on‑site redundancy—because if that generator is down, PJM is not obligated to serve you above your 100 MW contracted level.

This option is most attractive for very reliable on‑site resources (e.g., nuclear or very robust gas + storage setups) where the customer is willing to self‑insure part of the reliability risk.

Option 3: New Non‑Firm Contract Demand Transmission Service

Option 3 is structurally similar to Option 2, but the transmission service is non‑firm.

Again using the 1,000 MW load / 900 MW generator example:

The load can request non‑firm transmission service for some or all of its grid needs.

PJM can curtail that service when the system is constrained or during contingencies.

PJM explicitly has no obligation to serve the load if the grid is stressed or the generator is unavailable, beyond what’s specified in the non‑firm arrangement.

Implications:

This looks and feels like a classic “as‑available” service. You pay less, and in exchange you take the risk of being curtailed.

For data centers, this may only make sense when paired with substantial on‑site redundancy and/or flexible computing loads that can be shifted geographically or deferred.

Non‑firm service could also be relevant for incremental expansions where the customer is comfortable operating some capacity on a “best efforts” basis until upgrades catch up.

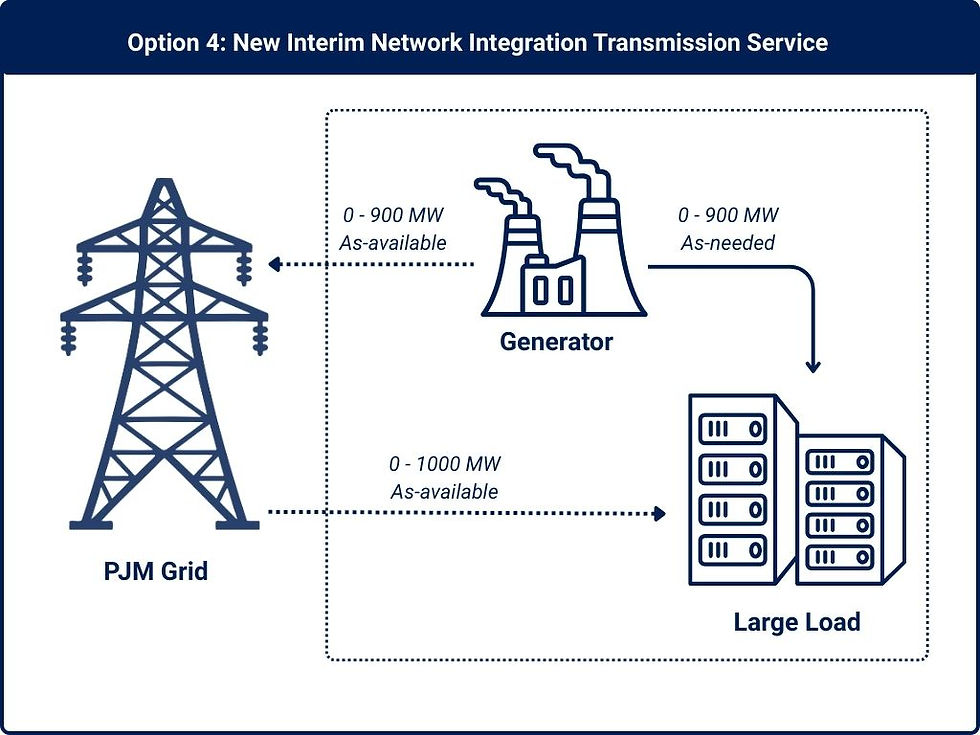

Option 4: New Interim Network Integration Transmission Service

Option 4 introduces an interim service concept that bridges the gap between “we can connect you electrically” and “all your network upgrades are in place.”

In this model:

The generator and large load interconnect physically.

PJM provides non‑firm service in the near term (similar to Option 3) while required network upgrades are being built.

Once upgrades are complete, the service converts to standard “front‑of‑meter” NITS as in Option 1.

Think of this as a “get you online sooner, but on non‑firm terms until the grid is ready” pathway.

Implications:

Useful when the physical interconnection can be built relatively quickly, but upstream transmission upgrades will take years.

Allows early utilization of on‑site generation and partial load while still acknowledging grid constraints.

For developers and lenders, the key questions become:

What are the curtailment risks during the interim period?

How binding is the conversion to firm NITS once upgrades are done (timing, cost certainty)?

3. What’s still unresolved: PJM’s next steps and open questions

FERC’s order and fact sheet lay out the framework, but a lot of critical details now hinge on PJM’s compliance filings and tariff language.

Compliance timeline and filings

FERC requires PJM to make several filings on staggered timelines:

Within ~30 days (by January 20, 2026): PJM must file tariff revisions addressing generator interconnection issues for co‑located facilities—how customers request interconnection below nameplate, when PJM can accelerate studies, and how surplus interconnection service can be used for new generation behind the same point.

By mid‑February 2026: PJM must submit broader tariff reforms to implement the new Firm Contract Demand, Non‑Firm Contract Demand, and Interim NITS options and to overhaul its BTMG rules.

Later in 2026: Stakeholders will file comments and protests; FERC will issue follow‑on orders accepting, modifying, or rejecting elements of PJM’s proposals.

As of late January 2026, FERC’s public summaries confirm the deadlines and the required content, but they do not yet provide a detailed breakdown of PJM’s January 20 filing itself.

Key design questions to watch

For developers and capital providers looking at co‑location or dedicated supply for data centers, several design points in PJM’s upcoming rules will be decisive:

How conservative is PJM’s reliability modeling under Firm Contract Demand?

If PJM still has to plan significant upgrades even when the firm demand is only 10% of the physical load, the economic value of Option 2 shrinks.

What protections and conditions come with Interim NITS?

How frequently can PJM curtail during the interim period? What guarantees exist around the timing and cost of eventual conversion to firm NITS?

How is behind‑the‑meter generation treated for capacity and cost allocation?

The threshold MW level for netting BTMG against load, and the rules for counting co‑located generation in capacity markets, will be crucial for data center economics and for hybrid “energy park” concepts.

How will PJM coordinate large co‑located loads with system protection and telemetry requirements?

Expect mandatory separate metering of generator output and large load, real‑time telemetry, and potentially custom special protection schemes before PJM will allow complex co‑located configurations.

What do financing markets do with these products?

Lenders and rating agencies will have to decide how to underwrite Firm vs Non‑Firm Contract Demand service, and how to treat Interim NITS periods when service is explicitly non‑firm. That will drive leverage ratios and cost of capital for co‑located projects.

What this means for data center strategies in PJM

In the near term, these new options mostly do three things:

Give large loads a way to pay only for the grid service they truly need, instead of forcing a 1,000 MW data center to buy 1,000 MW of firm service when it has a substantial on‑site generator.

Create a clearer path for projects that want to get online earlier on a non‑firm basis while waiting for full upgrades.

Provide regulatory clarity that should make it easier to structure long‑term contracts and financings for co‑located projects—at least relative to the ad‑hoc, non‑conforming approach that presented itself in the Talen–Amazon case.

What they don’t do is magically eliminate PJM’s interconnection queue or the operational complexity of running a data center plus a power plant as one integrated asset. Interconnection studies, permitting, and financing will still take years; what changes is the menu of ways you can slice the risk between PJM, the generator, and the load.

Closing thoughts

FERC’s December 2025 order is a real inflection point. Instead of trying to force co‑located arrangements into legacy categories—or rejecting them on a one‑off basis—it pushes PJM to create standardized products that acknowledge what’s really happening on the ground: large loads are arriving with their own dedicated generation, and they want more control over how much of that risk the grid is obligated to absorb.

The big decisions—how aggressive to be on Firm Contract Demand, how much non‑firm risk your load can tolerate, and whether Interim NITS can bridge your construction schedule—will only be clear once PJM’s detailed tariff language and planning assumptions are on the table. That’s the next crucial chapter to watch in 2026.

References:

https://introl.com/blog/ferc-pjm-colocation-ruling-data-center-power-plant-guide-2025

https://insidelines.pjm.com/pjm-completes-interconnection-reform-transition-cycle-1-studies/

https://www.powwr.com/blog/how-data-centers-are-reshaping-pjms-energy-market

https://www.jdsupra.com/legalnews/power-purchase-and-interconnection-9780454/

https://www.jdsupra.com/legalnews/large-load-interconnection-some-legal-7227123/

https://www.reccessary.com/en/news/amazon-nuclear-power-agreement-faces-setback-with-ferc-rejection

https://www.ans.org/news/2025-04-16/article-6937/ferc-denies-talen-amazon-agreementagain/

https://www.ferc.gov/news-events/news/presentation-e-1-pjm-co-location-proceeding

https://www.ferc.gov/news-events/news/summaries-january-2026-commission-meeting

https://www.stoel.com/insights/reports/energy-regulatory-updates/january-22-2026

Comments