PJM’s AI Power Puzzle: Why PJM Matters in the AI Energy Revolution?

- Dan Lee

- Feb 6, 2025

- 2 min read

Updated: Sep 4, 2025

PJM Interconnection – the deregulated power market in the U.S., serving 65 million people across 13 states and D.C – has emerged as the global epicenter of AI-driven electricity demand. In 2024, PJM Peak Load was 152 GW. It represents 20% of total US electricity demand and its Dominion zone is the corridor to 70% of global Internet traffic.

Part 1: PJM’s Top 3+3 Zones Driving 59 GW Surge

PJM’s 2025 load forecast released January 24, 2025, reveals 59 GW of new AI/data center driven demand by 2035 – equivalent to powering 45 million homes. But this growth concentrates across 3 zones accounting for ~80%: DOM (VA), AEP (OH/VA) and PL (PA).

Top 3+3 AI Load Hotspots

Key Observations:

DOM (Dominion) zone in Virginia shows the largest growth, adding over 18.7 GW of load.

All zones cite data center expansion as the primary driver.

AEP mentions a chip processing plant alongside data centers.

COMED includes EV battery manufacturing as a secondary growth factor.

Part 2: Efficiency Improvements vs. Accelerated Adoption

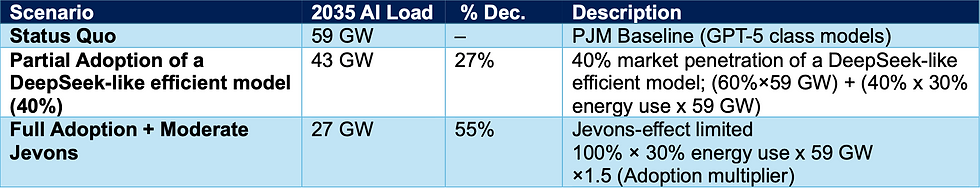

One of the key observations from DeepSeek (announced days after PJM’s load report) was that it introduced an (uncertain) alternative case for power demand, where Energy Consumption (Training) could be much lower than what was expected from other AI models. This is possible through DeepSeek’s “mixture of experts” training model architecture. However, its per query energy consumption (Inference) may be higher.

In general, there are three key efficiency levers that could result in revised downward load projections for PJM:

Training Energy: 10–40× less than GPT-5-class models

Lower Rack-Level Power Draw: 15–25 kW/rack vs. industry-standard 30–50 kW

Cooling: 30% lower energy via liquid immersion

Adjusted Forecast Scenarios

Part 3: Jevons Paradox – The Efficiency Trap

History warns that energy savings often spur demand growth. Ex: DOM Zone shows 5.8 GW "Rebound Effect" by 2040 from GenAI app proliferation.Efficiency around training energy could enable the entry of significantly more AI startups using equivalent energy.

Takeaways: Wiring the AI Future

1. Not all PJM Zones are growing equally.

Three pockets of PJM: DOM, AEP, COMED represent 80% of new demand growth.

2. Is it really more efficient?

When it comes to AI power demand, both Training and Inference consumption need to be considered; from there, what are the unknown use

cases (Jevons) that may be uncovered

as energy usage becomes more efficient.

3. Winter is Coming.

AI’s 24/7 loads narrow summer-winter demand gaps by 40%; the demand profile poses unique challenges and opportunities around grid reliability.

Data Sources:

PJM 2025 Long-Term Load Forecast dated January 24, 2025

PJM 2025 Load Report Tables – A1 through F3

Goldman Sachs Report: AI, data centers and the coming US power demand surge dated April 28, 2024

DeepSeek R1 Technical Brief dated January 22, 2025

MIT Technology Review: https://www.technologyreview.com/2025/01/31/1110776/deepseek-might-not-be-such-good-news-for-energy-after-all/

Associated Press: https://apnews.com/article/deepseek-ai-china-climate-fossil-fuels-00c594310b22afbf150559d08b43d3a5

Comments